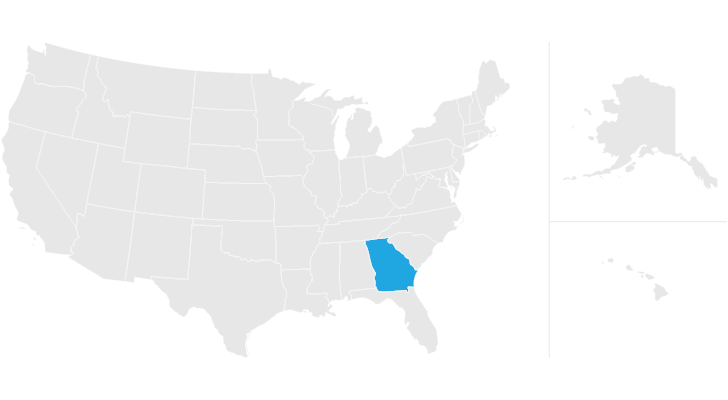

what is the inheritance tax in georgia

Moneyproperty inherited like this is subject to neither of those personal income taxes. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier.

An inheritance tax requires beneficiaries to pay taxes on assets and properties theyve inherited from someone who has died.

. No georgia does not have an inheritance tax. If Form T-20 is submitted the inheritor must title the vehicle in their name first before selling or transferring ownership. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. Estate tax is paid by an estate the collection of everything someone owned when they died and the tax comes out of the estates value before anything is passed on to beneficiaries. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000.

As of July 1 2014 Georgia does not have an estate tax either. However it does not mean that any resident of the state is ultimately free from any kind of tax due when they inherit property in Georgia. Georgia also has no gift tax.

Georgia does not have any inheritance tax or estate tax for 2012. These include Pennsylvania Maryland New Jersey Kentucky Nebraska and Iowa. The tax is paid by the estate before any assets are distributed to heirs.

Any deaths that occurred after July 1 2014 fall under this code. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Georgia is noticeably absent from both lists so residents who live.

An additional fifteen states also levy some type of estate tax. State inheritance tax rates range from 1 up to 16. There is no federal inheritance tax but there is a federal estate tax.

Just five states apply an inheritance tax. Inheritances that fall below these exemption amounts arent subject to the tax. While the estate tax is a federal tax an inheritance tax will only apply.

In this article we shall discuss everything you need to know about taxation laws for Georgia residents and ways to legally and easily reduce the possible taxable part of your estate. If the vehicle is currently in the TAVT system the family member can pay a reduced TAVT rate of 5 of the fair market value of the vehicle. For instance in Pennsylvania the inheritance tax applies to heirs who live out of state if the decedent lives in the Keystone State.

Estate tax is paid. There is no inheritance tax in Georgia. Inheritance tax is paid by the person who inherits something and its paid based on a percentage of the value of their inheritance.

First and second degree relatives are fully exempt from inheritance taxes. It is not paid by the person inheriting the assets. There is the federal estate tax to worry about potentially but the federal estate tax threshhold is current fairly high.

Surviving spouses are always exempt. Georgia does not have an Inheritance Tax. Check local laws to see if this might apply to you.

No Georgia does not have an estate tax or an inheritance tax on its inheritance laws. Nevertheless you may have to pay the estate tax levied by the federal government. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax.

Georgia has no inheritance tax. Another states inheritance tax could still apply to Georgia residents though. More on taxes and tax laws Ive got more good news for you.

Georgia Has no Inheritance Tax. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. However Georgia residents may still be on the hook for inheritance taxes if the state where.

From Fisher Investments 40 years managing money and helping thousands of families. Any deaths after July 1 2014 fall under these rules. Sometimes an inheritance tax is used interchangeably with the term estate tax Both are forms of so-called death taxes but in fact theyre two different types of taxes.

Any deaths after July 1 2014 fall under these rules. Georgia does not have an inheritance tax. Maintenance on Georgia Tax Center and Alcohol Licensing Portal will occur Sunday May 15 from 9 am to 7 pm.

Even with this welcome benefit there are some returns that must be filed on behalf of the decedent and their estate such as. Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. The federal gift tax has an exemption of.

If the vehicle is currently in the annual ad valorem tax system the family member has the option of staying under annual ad valorem OR paying full one-time TAVT. Inheritance of third and fourth degree relatives are taxed at 20 on their inheritance exceeding GEL150000 53571. Also called a death tax the estate tax is the final round of taxes someone pays before their property is distributed to their heirs.

In 2021 federal estate tax generally applies to assets over 117 million. A legible copy of No Administration Necessary may be submitted in lieu of Form T-20 Affidavit of Inheritance. The exact federal rules depend on the year in which your parent died.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. What Is an Inheritance Tax. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax.

Georgians are only accountable for federally-mandated estate taxes in cases in which the decedent and their beneficiaries live in Georgia. No Georgia does not have an inheritance tax. What is the inheritance tax in ga.

If you are the recipient of money or property under the will of someone you need not even report the receipt of that money on your Federal or GA personal income tax return. Inheritance - T-20 Affidavit of Inheritance required. Georgia does not have any inheritance.

Across the nation there are only six states that have an inheritance tax on their books. Georgias estate tax is based on the amount allowable as a credit for state death taxes on the federal estate tax return Form 706.

Sell Your House North Carolina Selling House Sell House Fast We Buy Houses

Estate Planning And Trust Documents 3 Ring Binder Zazzle Com Estate Planning Ring Binder Binder Design

Taxation In Georgia No More Tax

What You Need To Know About Georgia Inheritance Tax

What Is Inheritance Tax And Who Pays It Credit Karma Tax

It S Weekend Yaay Time To Take Stock And Be Thankful For The Past Week Have A Lovely One Accounting And Finance Academy The Past

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

The Updated Version Of The Terrible Towel Dailysnark Com Steelers Pittsburgh Pittsburg Steelers

Taxation In Georgia No More Tax

Georgia Estate Tax Everything You Need To Know Smartasset

Travelling In Europe Here Is How Much An Average Airbnb Costs In Each Country Europe Cheap Places To Go Airbnb

Property Investment Financial Planning Inheritance Tax Ltd Company Versus Private Personal Ownership Anyone Inheritance Tax Investment Property Inheritance

Keith Cochran P C Certified Public Accountant Cpa Serving The Chattanooga Area And Northwest Georgia Certified Public Accountant Money Matters Cpa

He Has A Point Lear New Yorker Cartoons King Lear Cartoon Posters

Watch Mail For Debit Card Stimulus Payment Prepaid Debit Cards Debit Card Visa Debit Card

What You Need To Know About Georgia Inheritance Tax

The Proposal 1942 By Kurt Schwitters 1887 1948 Andrea Abagnale Kurt Schwitters Art Art Terms